Frequently Asked Questions:

1. What is Tabit?

Answer: Tabit is our B2B Buy Now, Pay Later solution designed to make your purchases more flexible and manageable. It allows you to extend your payments from 4 weeks up to 52 weeks.

2. How do I apply for Tabit?

Answer: Applying for Tabit is quick and easy. The entire process can be completed online in just a few steps. You’ll need to provide some basic information about your business to get started.

3. Will applying for Tabit affect my credit score?

Answer: No, applying for Tabit involves a soft credit check for pre-approval, which means there is no impact on your credit score.

4. How does the payment extension work?

Answer: Once approved, you can choose to extend your payments from 4 weeks up to 52 weeks. This gives you the flexibility to manage your cash flow better and make strategic investments in your inventory and business operations.

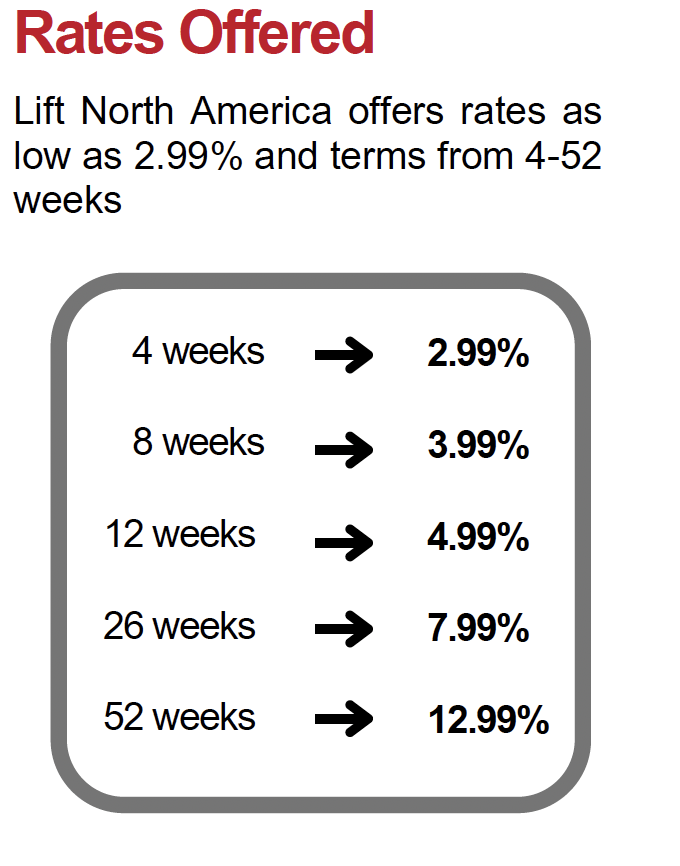

5. What are the interest rates for Tabit?

Answer: Our pricing is competitive and transparent. The rates range from 2.99% for 30 days up to 12.99% for 12 months.

6. Can I use Tabit more than once?

Answer: Yes, Tabit works as a revolving credit facility. Once you’re approved, you can use it repeatedly for your purchases without the need to reapply.

7. How quickly can I get approved and start using Tabit?

Answer: The approval process is designed to be quick. Once you submit your application, you can expect a response shortly, and upon approval, you can start using Tabit right away.

8. Are there any special offers for first-time users?

Answer: Yes, we offer special incentives for first-time users to make it even easier to get started with Tabit. Contact us for more details on the current promotions.

9. What kind of purchases can I make with Tabit?

Answer: You can use Tabit for a variety of business purchases, including inventory, equipment, and supplies from Lift North America.

10. Who can I contact if I have more questions or need help with the application?

Answer: Feel free to reach out to our support team at arap@liftnorthamerica.com, or you can contact your dedicated sales representative. We’re here to help!